When it comes to younger audiences, Gen Zers and millennials are still avid sports fans, but there are three key differences between them and older generations:

(1.) their time spent consuming sports, (2.) where they’re consuming sports, and (3.) their favorite sports are quite different. Last year, we saw shocking headlines declaring that NFL average viewership was down nine percent during the regular season, ESPN subscribers were down 13 percent over the past six years to 87 million, and younger generations were watching less sports programming. However, let’s put things into perspective. Across broadcast and cable airings, NFL programming still delivered an average audience of 14.4 million households that year. During the football season, ESPN and NBC had the most-watched programs of the week with Monday night and Sunday night football games in terms of both sheer audience size and across all male age segments. ESPN still regularly occupies its place as the most-watched cable network, averaging millions of viewers in prime time across both linear and streaming platforms.

TIME SPENT WITH LINEAR IS DECREASING…

Across all programming types, we know that younger audiences watch fewer hours of traditional linear TV than older generations.

Read MoreWhen it comes to younger audiences, Gen Zers and millennials are still avid sports fans, but there are three key differences between them and older generations:

(1.) their time spent consuming sports, (2.) where they’re consuming sports, and (3.) their favorite sports are quite different. Last year, we saw shocking headlines declaring that NFL average viewership was down nine percent during the regular season, ESPN subscribers were down 13 percent over the past six years to 87 million, and younger generations were watching less sports programming. However, let’s put things into perspective. Across broadcast and cable airings, NFL programming still delivered an average audience of 14.4 million households that year. During the football season, ESPN and NBC had the most-watched programs of the week with Monday night and Sunday night football games in terms of both sheer audience size and across all male age segments. ESPN still regularly occupies its place as the most-watched cable network, averaging millions of viewers in prime time across both linear and streaming platforms.

TIME SPENT WITH LINEAR IS DECREASING…

Across all programming types, we know that younger audiences watch fewer hours of traditional linear TV than older generations. Additionally, per Nielsen’s quarterly Comparable Metrics report, the time spent watching traditional TV is actually down across all age segments. Despite this, younger audiences are still watching live sporting events on traditional TV, and advertisers still have the ability to reach the greatest volume of people through linear broadcasts.

It all has to do with volume versus time. When looking just at the NFL and analyzing its drop in TV ratings, the overall reach for millennials did not decline, but their time spent viewing declined by six percent (to an average viewing of one hour and 12 minutes per game) and the overall number of games watched dropped by eight percent. Similar audience trends are occurring across the other major sports leagues. These leagues will need to make changes to their model in order to truncate the ratings decrease, as sports programming depends on live viewing more so than other programming categories which can recoup some TV ratings from time-shifted viewing and VOD. In a move that surely helps boost current ratings, Nielsen is now also capturing out-of-home (OOH) TV-viewing ratings to ensure that those audiences are being counted. OOH sports viewers are more likely to be younger audiences: last year the NFL saw the greatest lift in OOH TV viewing among adults 18 to 24. So while an in-stadium sign or a traditional :30 TV spot will certainly garner a massive amount of eyeballs, additional tactics should be explored in order to break through the clutter or drive specific action.

…WHILE TIME SPENT WITH DIGITAL IS INCREASING

While linear broadcasting still reaches the greatest volume of people, younger generations are shifting a portion of their habits to the digital space. According to research conducted by McKinsey & Company, millennials and Generation Xers watch nearly the same number of games per week on average (3.2 games versus 3.4 games). However, millennials are streaming these games via websites and apps nearly twice as often as older audiences (56 percent versus 29 percent). Media companies have taken notice and are changing their broadcasting models accordingly. Starting this spring, ESPN will offer an online subscription package to allow consumers the option to purchase specific programming, bypassing the need to pay for a cable subscription.

The NBA’s commissioner, Adam Silver, also recognizes that sports leagues will need to evolve their broadcasting formats in order to succeed. He envisions a future where NBA-streamed games and content would exist in an interactive platform similar to the popular gaming website, Twitch.tv. Given younger generations’ predilection for multi-tasking, this platform would allow fans the ability to jump in and out of live-streamed games with unlimited fields on the screen, quick access to description of plays and player stats, constant fan social chatter, and multiple audio feed options. Rather than repurposing the linear TV broadcast for online formats, this revolutionary approach would lend itself well to younger audiences as more fans access digital viewing outlets and provide additional opportunities for advertisers to partner with these platforms.

LEVERAGING THE POWER OF CONTENT ON SOCIAL

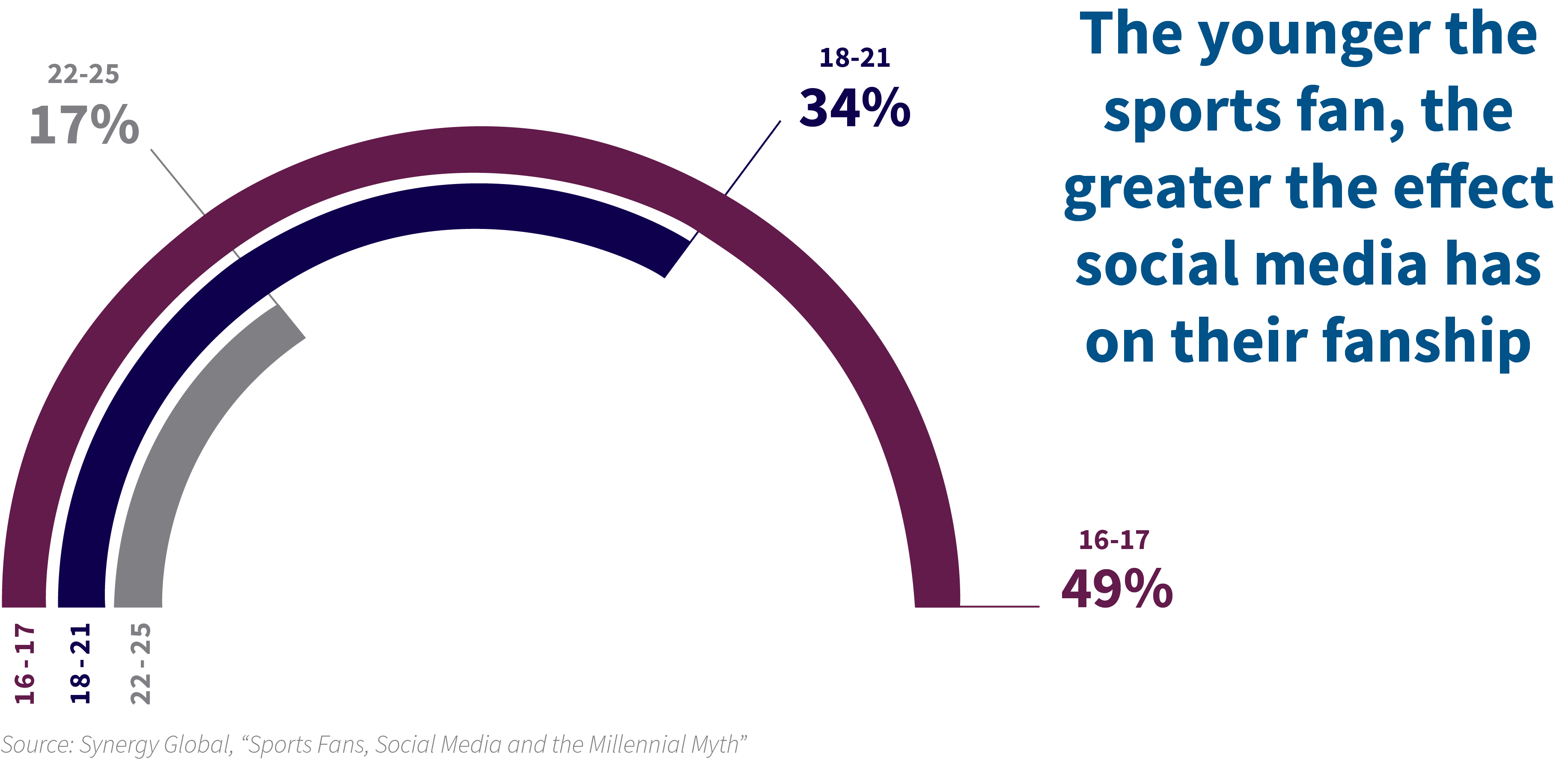

Young audiences aren’t just watching sports on digital channels, they’re talking about them and following them more on social media. Younger and older audiences are spending a comparable amount of time networking on social media apps, roughly 153 minutes per week on average. However, a greater share of younger audiences are following sports accounts on social media. Roughly 60 percent of millennials are using social networking sites to check scores and sports news updates, compared to 40 percent of Gen Xers. YouTube is the dominant online social video source for Gen Z; adults 18-24 are spending 37 minutes per day on the site versus Gen Xers at 15 minutes per day. Younger demos are also more likely than older audiences to consume sports content on Twitter, Snapchat, and Instagram.

Distributing content made for social is another area where certain leagues are separating themselves in terms of reaching younger audiences. Leagues such as the NBA, MLS, and English Premier League are very open to allowing their content to be shared across social platforms or on YouTube, resulting in top plays trending on Twitter or Instagram. Knowing that younger viewers utilize social media to get their sports content, highlights shared on these platforms is a highly effective way for leagues and advertisers to gain exposure with younger audiences. This is in stark contrast to a league like Major League Baseball, which is fiercely protective of the distribution of their content—highlights posted to YouTube or Twitter are removed almost immediately, and MLB highlights and streaming packages exist behind a paywall, forcing users to subscribe for a fee to access content. In the case of acquiring new, younger fans, MLB faces a bit of a Catch-22. A younger, unfamiliar sports novice is unlikely to opt to pay for baseball content without first being exposed to exciting highlights or other free content. According to Nielsen, 50 percent of the MLB’s audience today is 55 or older, an increase from 41 percent a decade ago.

Leagues such as the MLB or NFL, which are lagging behind in the race for younger fans, also struggle to market some of their young star players. Twenty-six-year-old Mike Trout of the Los Angeles Angels, two-time MLB MVP and six-time All Star, plays in the second largest market in the country and is one of the best young players in Major League Baseball. However, Trout, playing in a league that shies away from marketing individual players, is markedly less known to young viewers than the NBA’s young star Steph Curry. Look no further than Trout’s 1.4M followers on Instagram, dwarfed by Curry’s 19.6M followers, to see this discrepancy in popularity. Leagues facing problems with attracting younger audiences should look to loosen the reins on their content distribution on social platforms.

For advertisers, if the goal is to reach a younger consumer, then a digital feature should be considered as a complement to a larger partnership. The key to an advertiser’s success in this space will hinge on producing valuable, exclusive, or compelling content that motivates younger audiences to engage or take action.

SHIFTING SPORTS PREFERENCES

One other distinction is the sports leagues that younger generations favor. Gen Z and millennials are more interested in NBA, English Premiere League, MLS, and UFC than older generations. NBA enthusiasts are the most engaged fans on social media in comparison to other sports leagues. Leagues such as the NBA benefit from enabling their stars to be individuals and have a strong social media presence, which connects with a younger audience who enjoy the personal connection with their favorite athletes. It is not uncommon to hear of a millennial or Gen Zer who is a “Lebron fan” or “Steph Curry fan” as opposed to a “Cavs fan” or “Warriors fan.”

Perhaps as a result of this enthusiasm for individual players, the fantasy sports industry is now worth an estimated $7 billion per year and includes nearly 50 million players in North America. Attracting a younger audience (average age of 32), fantasy sports are an industry unto themselves as well as a boon to the respective professional teams providing the action. Over 60 percent of fantasy participants say they watch more live sports as a result of their involvement in fantasy teams.

Though football is the most popular fantasy sport, boasting a whopping 75 percent of all fantasy sport players, growth is tracking across all sports leagues. The appeal of a younger, mobile-driven and active audience has not been lost on the sports category and the NBA, MLB, NHL and even Formula One have deals, close ties, or open partnerships with sites like FanDuel and Draft Kings to grow their fan bases. Fantasy sports will continue to be a lucrative opportunity for leagues to expand their audience base and recruit younger fans, and for brands to align content with larger campaigns.

THE LAST WORD: PARTNERSHIPS FOR THE FUTURE

Advertisers that want to align their brand with sports teams and leagues in order to reach these younger demos need to prioritize their objectives. Leagues will need to make rapid changes to retain audiences both young and old, and advertisers will need to adjust with them. Leagues’ content and accessibility will need to be designed to reach fans as their digital behaviors evolve. Streaming sports content should be convenient and easily accessible. Leagues should also be targeting fans on social media channels. A successful sports marketing partnership and its components will be dictated by the brand/category awareness, messaging, target, objectives, seasonality, and geography. The best sports partnerships intertwine brands and teams across multiple media facets to create seamless messaging where fans are engaging with their favorite team. These tactics could include in-stadium signage, in-game features/contests, mobile extension, social sponsorship, mass-reaching traditional broadcast media spots, streaming media spots, on-site sampling or promotional giveaways, but there is not a one-size fits all solution when it comes to a sports marketing strategy.