In today’s video landscape, Nielsen’s panel audiences alone are no longer a viable way to accurately measure TV viewership. As part of the Nielsen One effort, Nielsen has been working since 2023 to enhance their existing measurement approach with “Big Data” and provide more accurate numbers for marketers. However, after analyzing impact data from their early efforts, Nielsen realized that Big Data needs some additional enhancements, and a full rollout has been pushed back to 2025. What exactly is Big Data, what are the new planned enhancements, and what should marketers be looking for as we get more information?

What is Big Data?

Big Data is a measurement and analysis method that combines Nielsen’s panels with additional data to provide a more accurate picture of TV viewership. This data is coming from over-the-air, cable, satellite, online, and out-of-home sources including new access to set-top boxes from Comcast, Charter, Dish, and Direct TV.

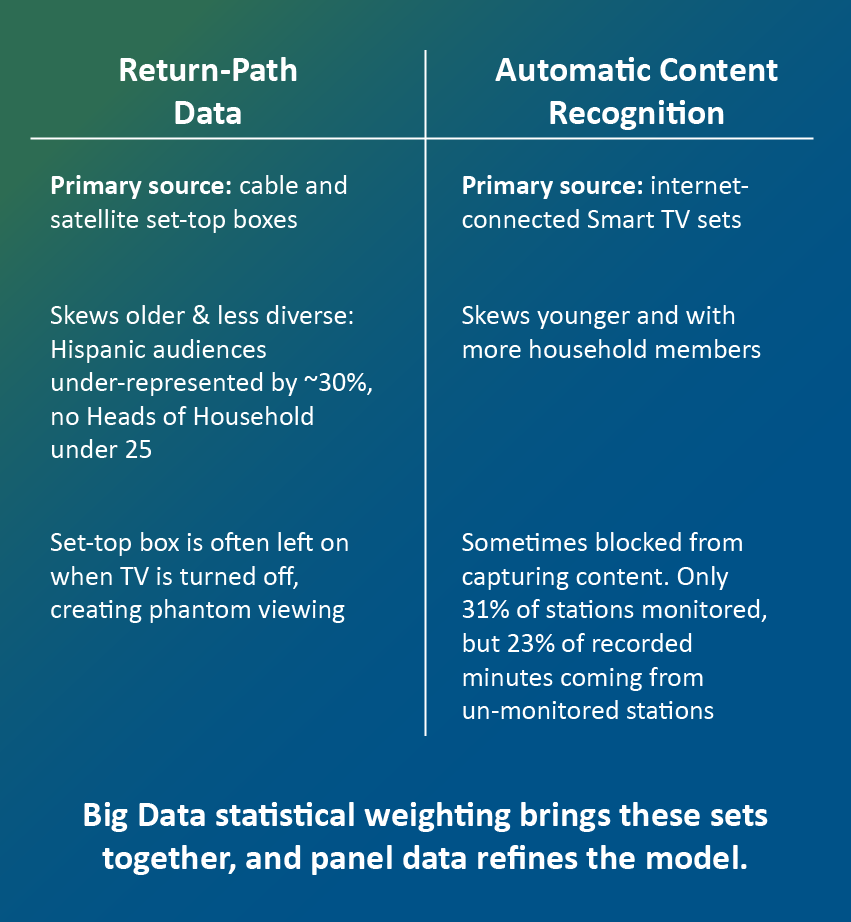

There are two types of data in the linear media world, produced by the systems that deliver programming to the user. Return-path data (RPD) comes from cable and satellite set-top boxes. Automatic content recognition (ACR) data comes from internet-connected Smart TV sets.

By using both RPD and ACR data, Nielsen will be able to find a balanced look at viewership, given the vast difference between age cells and how people access video. However, RPD or ACR data alone can also miss viewing habits throughout the household, thus misrepresenting households. The two data sets do not capture a full picture of viewing for households with multiple set-top boxes, or households with a mix of Smart TVs and non-Smart TVs. No one single solution can provide marketers the holistic picture needed to make smart buying decisions.

With all the concerns around RPD and ACR data, adding the Nielsen panel into the mix can help analytics resolve some issues. Nielsen can use the panels to identify the RPD/ACR homes and devices within the panel and determine where Big Data deviates and develop models to adjust for any anomalies.

In May 2024, Nielsen announced enhancements to Big Data without announcing a release date for live data availability. What are these enhancements that Nielsen has added?

- Conditional Demographic Collapsing: Demographic information from Nielsen panels will be used to inform Big Data. The enhancement will tailor demographic information to solve for zero cells. If a demo produces a zero on a given day and quarter-hour, Nielsen will now look back to only that demo (i.e., P18–34) from the previous week to see if there is viewing in the panel. Nielsen will go further to the previous month of data if necessary. All individual “Persons” demos are looked at now independently to determine if Nielsen needs to use more averaged data.

- More granular half-hour calibration periods: Nielsen originally looked at wide dayparts, i.e., 9a-1p. This diluted program viewing. Nielsen will now use half hours to be more program specific.

- Out-of-Home reverts to panel fusion: Nielsen measures out-of-home viewing in bars (sporting events) and friends’ homes (major events). Nielsen will use the demographic Persons data from the PPMs used in Out-of-Home viewing. Demographic estimates from the out-of-home panel will be fused with Big Data to provide more accurate out-of-home viewing.

What are the benefits for Big Data and the enhancements?

By continuing to use Nielsen’s panels alongside Big Data, we have actual human interaction combining with data to determine impressions. There is no perfect resource, but these enhancements should provide more stable data and a reduction in zero cells (for example program delivery could show a 2.2 Impressions on a Monday and a 0 impression on a Tuesday, which is highly unlikely).

Look at Chicago: the market currently consists of 1,000 Households for measurement. With the addition of Big Data, that number increases to 915,000 Households. Again, the RPD/ACR households will have anomalies, but with the 1,000-base measurement, Nielsen can adjust. Also, with the impact data currently available, in Chicago the zero cells were reduced 100% across all broadcast stations. This is a high percentage for any market, but Nielsen expects the reduction to be 90%+ in most markets.

This is a lot. What does this all mean for marketers?

Nielsen is behind in an ever-changing industry where marketers need increasing data accuracy and availability in order to make the most of their media dollars. And Nielsen isn’t alone in struggling with this; Comscore is continually threatening Nielsen’s position as the leader in the TV measurement space, but their approach isn’t perfect either—Comscore still applies viewership unilaterally to everyone in the household regardless of what’s on the TV.

However, if Nielsen’s enhancements to Big Data and Nielsen One work as planned, creating more stable data and reducing zero cells, we should expect an increase in available impressions within markets. Big Data is a critical adjustment so advertisers and media buyers can be confident that their buys are accurately reflecting viewership in today’s landscape.

With any luck, Nielsen’s rollout happens sooner rather than later in the 2025 window. We’re anticipating a full rollout in Q3, though it’s possible but unlikely that Nielsen pushes release back. Unlike Google’s depreciation of cookies which, after years of being delayed, is now stalled indefinitely, competitive pressure means that Nielsen must adjust to the market and is likely moving as quickly as possible to deliver.