Everyone knows the video landscape is changing. The evolution began ten years ago and continues to accelerate as content creators, owners, and distributors make more videos available in multi-platform environments.

Consumers have begun to adapt to the various video platforms as they seek entertainment and news options on their time schedules and choice of device, but the most unique audiences are the ones who were born into, and have grown up in, this new, multi-platform world. These younger consumers are creating demand for video content in an ever-increasing range of formats and causing brands to revamp their video content as it currently exists, while also rethinking their approach to this format as a whole.

LET’S NOT MAKE IT COMPLICATED

How then do consumers classify “video” in today’s world? The answer to that depends on your audience. For Gen X audiences (ages 40 to 54) video and TV are clearly delineated and their definition is driven by the source of the signal. Gen X recognizes the difference between the familiar experience of broadcast cable content on their living room televisions and online access to streaming content via major hubs like Netflix or Amazon.

Read MoreEveryone knows the video landscape is changing. The evolution began ten years ago and continues to accelerate as content creators, owners, and distributors make more videos available in multi-platform environments.

Consumers have begun to adapt to the various video platforms as they seek entertainment and news options on their time schedules and choice of device, but the most unique audiences are the ones who were born into, and have grown up in, this new, multi-platform world. These younger consumers are creating demand for video content in an ever-increasing range of formats and causing brands to revamp their video content as it currently exists, while also rethinking their approach to this format as a whole.

LET’S NOT MAKE IT COMPLICATED

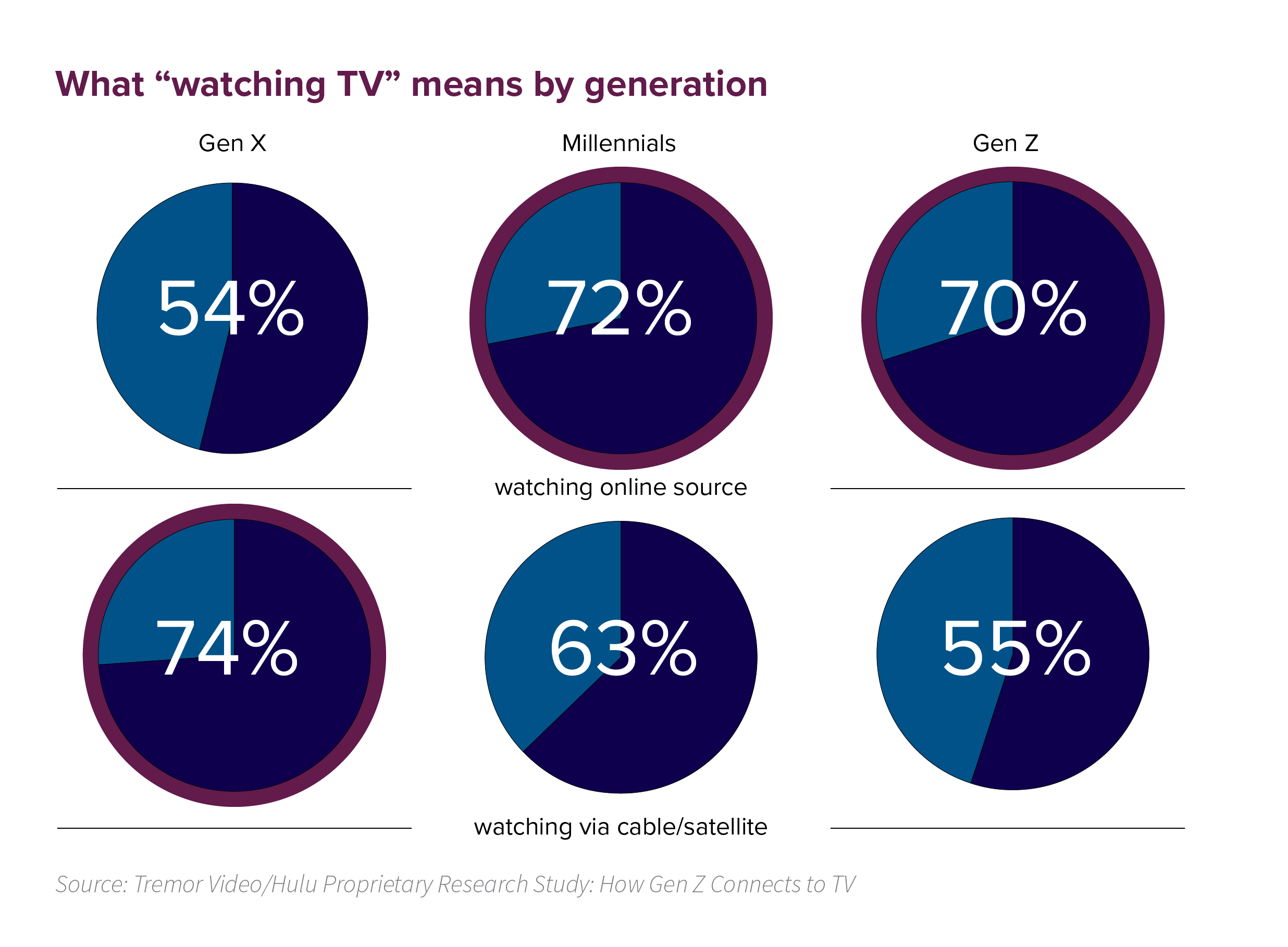

How then do consumers classify “video” in today’s world? The answer to that depends on your audience. For Gen X audiences (ages 40 to 54) video and TV are clearly delineated and their definition is driven by the source of the signal. Gen X recognizes the difference between the familiar experience of broadcast cable content on their living room televisions and online access to streaming content via major hubs like Netflix or Amazon. However, younger generations have a much different relationship with video. Millennials and the new sought-after demo of Gen Z associate video with the type of content they are viewing, as opposed to the device on which they are viewing or the source of the signal. This forward-thinking “video is video” mindset is a result of increased access to technology, as a plethora of devices have been available to both of these younger generations for the majority, if not the entirety, of their lifetimes. Digital technology is now as common a utility in homes as electricity and water, and its ubiquity nearly eliminates the concept of being “offline”—these generations are always plugged in. As more and more young viewers come of age in a digital environment, the lines between online video and traditional TV will continue to blur and change the way content creators and advertisers view platforms.

Despite trends indicating that fewer millennials and Gen Zers are investing in a cable subscription each year, both generations are still watching a significant amount of linear TV. Nielsen reports that 70 percent of Gen Z watches more than two hours of TV per day, just behind millennials who consume 2.25 hours a day. However, as subscription-based streaming services have grown in popularity, a new normal has emerged for accessing and consuming video content. While older generations, including millennials, can easily differentiate between traditional cable and OTT services, the Gen Z audience sees no such differentiation—it’s all TV. In a Tremor video study, 84 percent of Gen Zers said they considered streaming an online show through their television sets as “watching TV.” This is a departure from how the millennials surveyed in that report classify TV, defining it as solely cable- or satellite-provided services. Because Gen Z has always had access to content via a multitude of services, their primary focus is on the programming consumed and not the actual service, or even device, used to consume it.

Nevertheless, device also serves as a key differentiator between how these two generations consume video. Millennials and Gen Zers are largely consuming video on desktop computers or televisions at similar rates. However, Gen Zers are more likely to watch on their mobile phone than their millennial counterparts, while millennials are consuming via a tablet at a much higher rate. As mobile devices become more sophisticated, and as generations are given access to them at a younger age, the tablet has come to play a smaller role in video consumption for Gen Z. Over time, tablets have begun to be edged out by mobile devices and gaming consoles. This is reinforced by the finding in a Tremor and Hulu study that a very healthy 25 percent of Gen Zers are using their video game console, such as a PlayStation or Xbox, to access online content including movies and television. So ultimately, while it seems that slightly older millennials are leaning more on tablets to supplement desktop video consumption, Gen Zers are more comfortable consuming on mobile and also more open to using alternative devices. For advertisers, this means expanding the consideration set for video beyond just linear television in order to reach these younger demographics.

WHAT’S OLD IS NEW AGAIN?

WHAT’S OLD IS NEW AGAIN?Even though Gen Z is reshaping the qualifications of the video landscape, Tremor and Hulu found their viewing habits to be more similar to Gen X rather than the closer-in-age millennials. Both younger audiences expect TV content to be accessible in a way that caters to their lifestyle—available whenever they want it, wherever they want it. But while millennials are more actively seeking out specific content and genres, Gen Z is 21 percent more likely to surf through channels and flip through programs to find entertainment of interest. In fact, this more passive approach to video is similar to Gen X‘s consumption behaviors, showing a potential shift in content discovery based on life stage and available technology. Since Gen X and Gen Z are both likely to live in households with access to traditional cable as well as some kind of OTT device, their entertainment discovery process is unsurprisingly similar.

Millennials, on the other hand, tend to focus their viewing on the more economically-efficient online video space. This could be attributed to a majority of the target group having a lower disposable income as well as not having access to a plethora of traditional and digital video options from which to choose. Necessity, therefore, is likely one of the primary drivers for millennials’ video decisions as they focus on word-of-mouth and social suggestion for their entertainment selections.

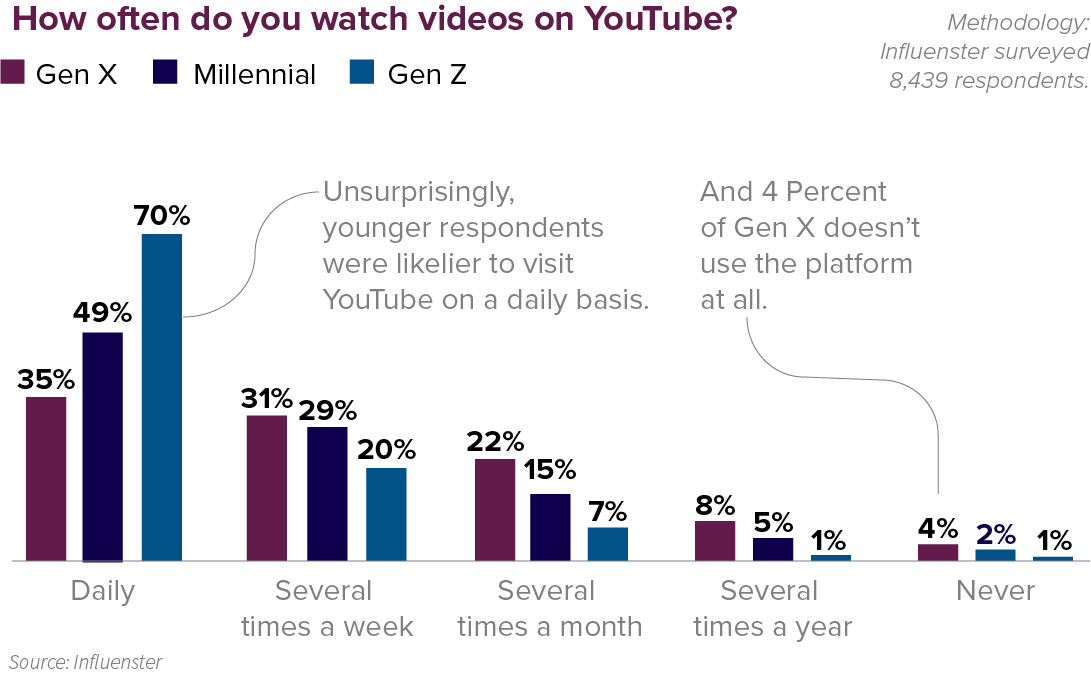

Regardless of the disparities in the TV consumption space, millennials and Gen Z both spend a majority of their time (59 percent) watching video formats on a digital platform, according to an Adweek study. As younger generations’ access to various screen types and content choices expand, KSM anticipates this number will continue to grow each year. While both audiences are heavy digital video consumers, they are still engaging with content differently. Millennials are continuing to consume digital video “the traditional way” through digital publishers’ home pages and apps. They rely heavily on the publisher to provide entertainment and to make it readily available through a central hub. Gen Z, however, is constantly bouncing back and forth through video platforms, looking for their favorite influencer’s content or publishing their own. Gen Z is a generation molded by relatable influencers, easily reachable through numerous social platforms. This explains the rise of YouTube as a dominant video platform, with 35 percent of millennials and a whopping 95 percent of Gen Zers regularly consuming content on the platform, as reported in a Trifecta study.

THE NEW “TUBE”

THE NEW “TUBE”So, what makes YouTube content so engaging? Most likely, it’s the unique publishers, since both generations are spending increasing amounts of time on the platform watching user-generated content. This includes things like product reviews, how-to videos, and their favorite social influencer’s blogs. Very specific sub-segments are rapidly gaining traction in the YouTube space, offering advertisers an enlarging video environment to capture valuable millennial and Gen Z attention. Genres like haul and unboxing videos are joining gaming as some of the most popular categories for younger consumers. Haul videos showcase a consumer displaying specific items from a recent, often expensive, shopping spree. Similar to product review videos, the content focuses on giving the viewer the experience of seeing the designer goods “up close,” accompanied by the host’s initial thoughts behind the products themselves. Beauty and fashion brands are already using this type of content to seamlessly introduce their products to consumers through a trusted source and in a non-intrusive way.

Other emerging content focuses on video games and showcases the overall gaming lifestyle. Gaming how-to videos give engaged consumers tricks and tips on defeating various games as well as highlight reviews on new products. These “new” celebrities are actually people playing various games in real time, and offering viewers insights or secrets to better their own gaming techniques. Although the content itself is not as high quality as prime network TV programming, it is a growing space worthy of advertiser attention. This interactive video experience is stealing time away from traditional video content, and it’s important for brands to take note and act accordingly.

THE LAST WORD: A WAY FORWARD FOR “VIDEO”

Once the hub for short-form cat videos and other low-quality, user-generated content, YouTube has come into its own as a very viable long-form alternative in the user generated space. As more and more young viewers find interest in new video genres like haul videos and gaming insight, it is expected that time spent with online video will increase rapidly. As younger consumers increasingly turn to unconventional video formats for entertainment, advertisers must open their consideration set beyond multi-platform to multi-content strategies. Advertisers should not fear user-generated content, but embrace it. This new way of looking at video has great influence and power to help cultivate strong connections between brands and the evolving younger generations.