Though often overshadowed by video’s growth explosion during the last five years, the audio landscape has experienced some dramatic changes as adoption of new audio platforms has slowly but surely become ubiquitous. However, unlike other “legacy” media vehicles like print or even linear TV, terrestrial radio (also known as AM/FM) has maintained its audiences surprisingly well.

With a national reach average of 93 percent, radio now boasts the highest reach of any medium in today’s landscape in spite of a mature digital revolution and rapidly-changing consumer tastes. While 2017 marked further growth for online audio with a full 61 percent of U.S. adults over the age of 12 listening weekly, AM/FM still holds broader tune-in levels. Nielsen reports that even 90 percent of the fickle 18 to 34 audience still listens weekly, a statistic that does not fail to surprise in light of the rapid declines other “legacy” media vehicles have seen. In fact, against all odds, the AM/FM audience has actually grown over the last year through expanding Hispanic and African American listening groups. This ultimately shows signs of longer-term staying power for the format, by way of loyalty in these two powerhouse target segments. According to Nielsen,

Read MoreThough often overshadowed by video’s growth explosion during the last five years, the audio landscape has experienced some dramatic changes as adoption of new audio platforms has slowly but surely become ubiquitous. However, unlike other “legacy” media vehicles like print or even linear TV, terrestrial radio (also known as AM/FM) has maintained its audiences surprisingly well.

With a national reach average of 93 percent, radio now boasts the highest reach of any medium in today’s landscape in spite of a mature digital revolution and rapidly-changing consumer tastes. While 2017 marked further growth for online audio with a full 61 percent of U.S. adults over the age of 12 listening weekly, AM/FM still holds broader tune-in levels. Nielsen reports that even 90 percent of the fickle 18 to 34 audience still listens weekly, a statistic that does not fail to surprise in light of the rapid declines other “legacy” media vehicles have seen. In fact, against all odds, the AM/FM audience has actually grown over the last year through expanding Hispanic and African American listening groups. This ultimately shows signs of longer-term staying power for the format, by way of loyalty in these two powerhouse target segments. According to Nielsen, Hispanics and African Americans now make up nearly one-third of radio’s total listening audience.

So why has radio been able to stubbornly hold onto American audiences? For a number of reasons, mostly related to convenience and cost. The Edison Infinite Dial 2017 Study showed that 82 percent of adults over 18 listen to traditional AM/FM radio in their cars, while only 45 percent listen to digital owned music, and a mere 26 percent stream digital audio. This is because most cars on the road today do not have Bluetooth technology or even basic streaming adaptors. In addition, terrestrial radio boasts a number of positive attributes even in an increasingly digital world: AM/FM requires no monthly subscription fees and, more importantly, is not a drain on your phone’s monthly data usage.

Impending shifts?

Up to this point, audiences have simply expanded their music consumption time to include online listening hours, which hasn’t hurt terrestrial radio at all. However, recent revelations regarding consumer perception, technology shifts and expanding digital audio adoption may represent signs of a shifting scale in the near future.

According to Edison Research, 83 percent of 12- to 24-year-olds now listen to streaming audio on a weekly basis. This is ubiquitous, and marks a rising demographic of digital-audio loyalists who may not share their parents’ interest in terrestrial formats. In addition, as younger demographics buy fewer cars, the opportunity for optimal in-car listening is removed from the adoption timeline.

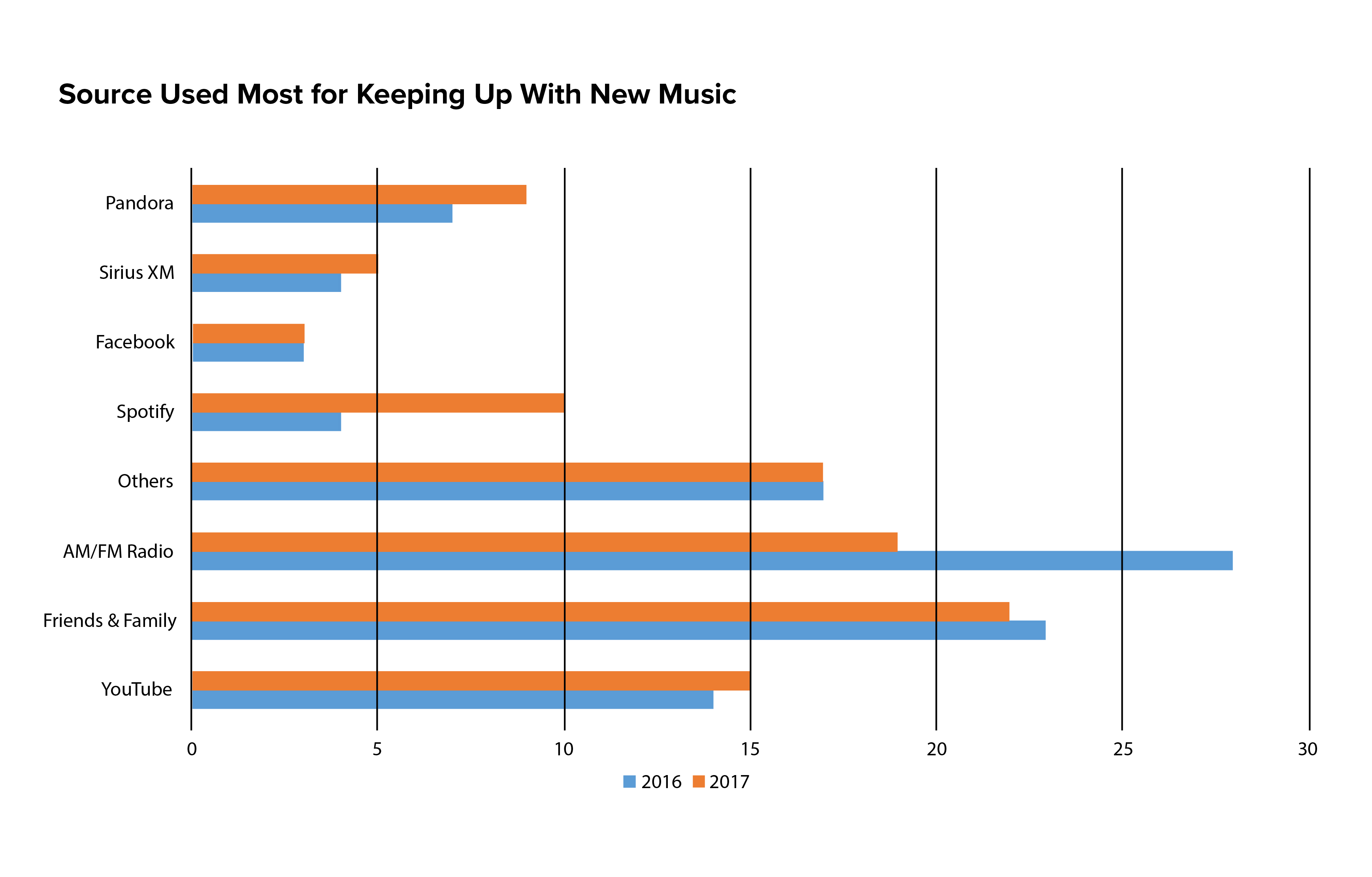

This year’s Nielsen Audio Today report also showed the first dramatic drop in the amount of respondents naming terrestrial radio as “the source used most often for finding new music.” Dropping from nearly 30 percent to 19 percent is a major hit to what was historically one of AM/FM’s largest draws. Recent updates and upgrades to some of the more popular streaming audio platforms may be the primary reason for this shift, as consumers find these digital interfaces easier to navigate and the technology for delivering more relevant music options increasingly sophisticated.

Radio ownership has also dropped dramatically. Edison reports that 94 percent of 18- to 34-year-olds owned a radio in 2008; today, only 68 percent own at least one and 32 percent do not have any in the household. This means continued listenership will increasingly rely on in-car activity, an audience that is threatened with replacement as each new car packed with streaming capabilities hits the road.

In addition, younger audiences have been shown to possess a lower tolerance for ads; 25 percent tune away immediately at the start of a commercial break. Since terrestrial pods have become increasingly long, AM/FM might actually be succeeding in halting any possible terrestrial adoption as those aged 18 to 24 flee to digital audio platforms for shorter pods and more music time per hour.

Finally, the recording Industry Association of America (RIAA) reported that 2016 was the first year streaming’s share of U.S.-recorded music revenues passed the 50 percent mark. Increasing declines in physical music sales (which now only make up 22 percent of the total music market) and a nearly 40 percent drop in digital downloads of music are contributors to streaming’s rising share. In fact, digital revenues are generated primarily by paid subscriptions to streaming audio services, so most growth can be credited to the slow rise of streaming audio.

Streaming juggernauts

To capitalize on what seems to be a tipping point in adoption and more regular usage of streaming audio, Spotify and Pandora have started a healthy battle for loyalists. Neither company has turned a profit since its inception and both very badly need to increase revenue in light of ever-rising royalty fees. Most analysts believe the only way for these companies to remain viable as full streaming offerings is to incite more regular usage through paid subscriptions. Ensuring consistent revenue would allow Pandora and Spotify to keep up with royalty agreements and pay artists fairly. A solid subscription base would also create user loyalty, something both platforms crave and would be the answer to revenue consistency issues.

Unfortunately for them, but fortunately for advertisers, neither entity has historically boasted a large U.S. subscriber base. Similar to the Netflix video model, paid subscribers to Pandora and Spotify are entitled to ad-free listening sessions, thereby removing them from the targetable listener pool. If long-term viability means large subscription bases and zero advertising models, then clearly increased streaming-audio listenership is not necessarily a positive for advertisers.

Spotify has aggressively sought new subscribers by applying several heavy discounts to their unlimited, on-demand user interface. By offering discounts for college students and “family plans” allowing five subscribers on a single $20 subscription base, Spotify was able to increase overall worldwide subs by 20 million in a single 10-month period.

Though not widely publicized, it is estimated that Spotify’s subscription base is approximately 35 percent of their total listeners while Pandora’s is just over 5 percent. This large difference may be indicative of the long-term goals of each company. Spotify has always been eager to be the first to break the revenue barrier and turn a profit through subscriptions, while Pandora has struggled over the last year simply to stop the bleeding as they lost massive amounts of share to Spotify’s deep discounting incentives. Specifically, younger and more price-conscious users flocked to Spotify’s platform as they took advantage of the discounted, on-demand music selection. The numbers were astounding. Spotify’s monthly users within the 12 to 24 age segment jumped from 30 percent in 2016 to 45 percent in 2017. At the same time, Pandora’s share of this group dropped from 43 percent to 39 percent.

In an effort to combat Spotify’s growth, Pandora went back to the drawing board and upgraded their interface and user model. They added a robust on-demand service to address consumers’ desire for track-specific listening and music ownership surrogacy, similar to Spotify’s model. But even more interesting was their inclusion of creative advertising ideas offering brands the opportunity to appear outside of a traditional ad pod and consumers more control over ad environments. Listeners have the chance to skip or replay songs on the Pandora free platform in exchange for watching an ad in its entirety. This model creates a win for everyone: consumers get free added features with their listening experience, brands run in impactful environments targeted to the right listeners, Pandora gains more ad revenue, and hopefully maintains an open advertising environment for the future without enticing a huge listener base into an ad-free model.

Looking ahead

It is likely that 2018 will be a telling year in the audio landscape due to these major streaming model shifts. Pandora will publish the results of their new interface and potential increase in ad dollars and Spotify may find themselves in profitable territory, albeit without the opportunity for future advertising dollars against their subscriber base.

On the other hand, the seeming impending decline in terrestrial audiences will take longer than a single year to show a dramatic shift. AM/FM radio will maintain solid reach until the 12- to 24-year-old online audio addicts choose to walk away from terrestrial altogether as they come of age. In the meantime, marketers should keep in mind that traditional radio retains reach while streaming properties act as complementary vehicles to provide coverage against light terrestrial users.