The video landscape has changed dramatically in the last five years as technology and viewing habits have evolved. As a result, the job of marketers has had to evolve right alongside it. With such a wealth of new technologies, acronyms, and developments, it is easy to lose sight of which technologies have real lasting potential and power.

Addressable TV, or the ability to target linear TV audiences on a one-to-one basis, is one term that has stood the test of time. But what’s the latest state of this technology? And how does it differ from other approaches to video across linear TV and OTT?

Need a Refresher on Addressable TV?

Addressable TV delivers differing, targeted ads at the household level based on data gathered through set-top boxes (STBs) and 3rd party sources. Addressable TV advertising is different from traditional TV advertising in that it targets a specific audience as opposed to specific network, program, and time of day. Essentially, this makes TV buying similar to digital; there are fewer wasted impressions with more measurability. The consumer, however, sees these ads like any other on their TV.

Addressable capabilities currently exist in roughly 75 million households, or just over half of TV households in America. All cable and satellite providers have been collecting STB data for some time now—well over a decade—but the ability to link that information with 3rd party data has only recently become available. Only AT&T’s U-verse or DirecTV, and Dish Network, offer true addressable—the delivery of targeted ads on a household level—but cable providers are not far behind. Comcast, for example, cannot yet serve addressable ads. However, it currently uses STB and 3rd party data to build out smarter buys (i.e., determine the best networks, programs, and dayparts to reach the target). The message is still delivered to the entire market, but Comcast believes the “true” target is better reached by applying this technology.

At this point in time, given the growing but still relatively low scale, true addressable TV advertising makes most sense for national and regional advertisers. The advertisers who have been quicker to try addressable fall into categories such as automotive, insurance, CPG, and retail.

For starters, it’s important to understand the simple difference between traditional and addressable TV. As we all know, the traditional linear TV model has advertisers insert an advertisement into a program with the benefit of reaching a wide audience and variety of people. This method isn’t going away anytime soon, and linear still dominates when it comes to the highest reach at some of the most efficient costs. Addressable TV, on the other hand, still operates within the linear TV ecosystem, but allows advertisers to identify and serve each individual target household a unique ad. It allows advertisers to go directly to consumers with a relevant message, rather than consumers happening upon an advertiser’s message. As addressable technology continues to advance, it will serve as an important complement to, rather than a complete replacement of, marketers’ video campaign needs.

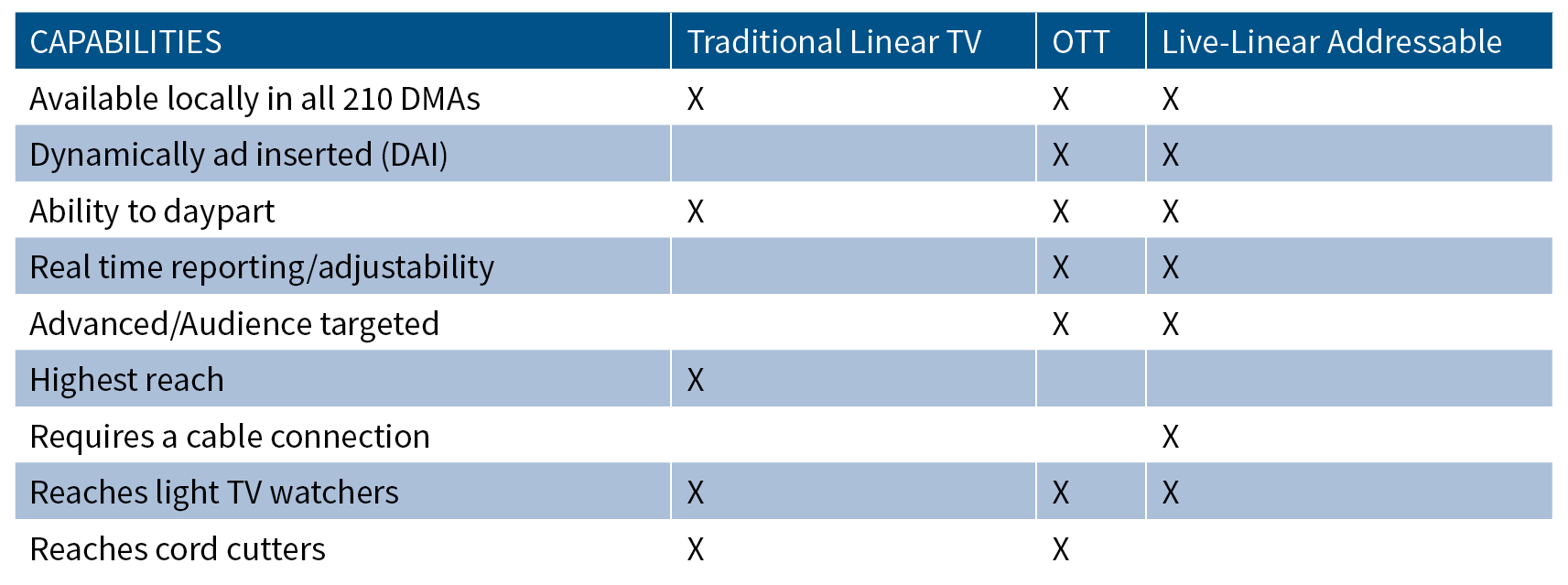

When zooming out and comparing the full capabilities of OTT, live-linear addressable, and traditional linear TV, it is important to reiterate that each category complements the other. While technology and innovation in the video space are growing at exponential rates, both KSM and the industry at large agree that any one (traditional linear, addressable live-linear, and OTT) will not and should not replace the other.

Here are key steps in building a live-linear addressable TV ad campaign:

- Define, build, and segment your audience

- Find targeted audience

- Serve/distribute addressable ads to specific households

- Analyze results and optimize campaign in real time

WHAT IS KSM’S TAKE ON ADDRESSABLE?

KSM views addressable as the overarching umbrella under which the OTT and live-linear addressable subcategories fall. KSM sees this as an opportunity to enhance linear TV schedules with a targeted TV component. Although CPMs on linear addressable are higher than upfront linear TV buys, there are no wasted impressions. CPMs on linear addressable vary and are contingent on how much targeting is layered in. More targeting means less scale. On a linear buy, in which advertisers are typically purchasing on demo, said advertiser may get a CPM that is $20 on adults 25 to 54. Conversely, linear addressable can become at least double that cost if the advertiser is just targeting by demo and can skyrocket to a $100 or $1,000 CPM if they layer in more granular targeting, depending on scale.

The key benefit of addressable is that impressions are never wasted. Let’s use an automotive trucks brand as an example. With a linear addressable buy with targeting layered in, this brand can reach TV viewers who are in market to purchase a truck or who own one already. On a traditional linear buy, there is some waste on an Adults 25 to 54 demo guarantee buy, as half of that audience may consist of people who typically do not index high on owning trucks. Then, looking deeper at the truck-friendly audience within that Adults 25 to 54 demo, one would notice that only 10-20% of this core demo are actually in-market to purchase a truck. From that perspective, one might view the linear buy’s “true” CPM as being on par with the cost of linear addressable.

Traditional linear and addressable each have their benefits. The benefit of linear TV is the enormous scale and wealth of available TV households. This massive reach is a major and lasting appeal. Live-linear addressable’s key benefit is relevance. With addressable, advertisers are ensuring that their message is delivered to the key target audience while said target is watching TV. There is no waste.

Going back to the automotive example: with addressable, only those looking to buy a truck are served a truck ad.

Addressable TV can serve as a compliment to a linear TV buy and bridge the gaps in viewership by delivering targeted ads to audiences that were either being missed or were tuning out on the linear buys. In other words, the implementation of data on addressable further enhances a linear TV buy. That said, addressable TV does come with some limitations. In some cases, networks and OTT providers selling data-driven advertising have prevented advertisers from taking data to maintain their competitive offering. However as of late, momentum for linear addressable seems to be shifting once again in the right direction.

WHO ARE THE MAJOR PLAYERS IN LINEAR ADDRESSABLE?

While addressable TV is a hot topic in the industry, there really are very few players in the space. When AppNexus was acquired by AT&T in a $1.6 billion sale back in June of 2018, it allowed AppNexus to apply its technology and offer advanced TV advertising solutions. Using this AppNexus technology, Xandr, AT&T’s ad sales and tech unit, became the main player in the addressable TV space. Xandr has also entered agreements to aggregate and sell national addressable TV inventory for new clients Frontier Communications and Altice USA, which now allows for Xandr to offer live-linear addressable on a regional level (they require a four-state minimum on each campaign), as well as the national level.

Xandr’s unique advantage in the addressable TV space is its scale. It can offer all AT&T inventory, including DirecTV, Frontier, and Altice. With the AT&T and Time Warner merger, Xandr will also be able to leverage additional networks such as TNT, TBS, TruTV, CNN, and Adult Swim. All of this combined represents a massive amount of inventory. Its appeal is also bolstered by the fact that Xandr’s 25 million addressable households is by far the most scale in the addressable space. And along with the live-linear addressable TV platform, Xandr can also provide cross-screen addressable and programmatic ads through its DSP (via the AppNexus Programmable Platform).

But even with some technological ground gained, issues with scale and the complexity of the market are constant thorns in the sides of today’s linear addressable advertisers. NCC Media, the exclusive ad sales and tech unit of Comcast, Charter, and Cox, is another big player in addressable inventory, offering addressable across a full spectrum of channels and screens. But while Xandr and NCC Media have similar offerings, Xandr is a leader in live-linear addressable while NCC, at the moment, has more VOD than live-linear addressable offerings. This is just one example of how today’s addressable landscape forces advertisers into a complex scenario where they’re left trying to figure out which inventory provider (or mix of providers) in this fragmented ecosystem will best deliver on campaign goals at scale. That said, it’s worth noting that NCC’s ability to reach 80 million U.S. households across its three cable operator owners means it will be a force to be reckoned with once its live-linear addressable capabilities are improved.

And beyond just scale, competitors in the space still need to enhance their overall standards and offerings for addressable TV to continue to evolve. At this year’s Cannes Film Festival, media companies Comcast, Disney Media Networks, WarnerMedia, AT&T’s Xandr, CBS, Fox, Discovery, Hearst Television, and AMC Networks, along with agencies, announced Project OAR, which stands for Open Addressable Ready. Its purpose is to develop true standards for addressable advertising on smart TVs and connected devices. Such an offering is not expected to come to fruition until the first half of 2020.

But the focus on addressable at Cannes didn’t end there. Another big splash came when Comcast, Charter Communications, and Cox Communications together launched an initiative called “On Addressability” with the goal of creating an addressable offering that is sound and scalable. In doing so, they put a clear stake in the ground about the need for unity and a coming together of TV companies to allow for advertisers to have better targeting and more efficient measurement on their TV buys.

All of these companies are leading the charge to develop definitions and standards of addressable, while educating advertisers on the value and identifying best practices for transacting on addressable campaigns. And now that cable providers such as Comcast, Cox, and Charter have joined in on the addressable offerings, it should allow advertisers to take advantage of data-driven solutions down to the local level. This would be a monumental step forward, as it would provide local buyers with the ability to buy outside of a broad geographic target.

Even with some technological ground gained, issues with scale and the complexity of the market are constant thorns in the sides of today’s linear addressable advertisers.

WHAT’S NEXT?

The growing trend that cable and satellite TV providers fear most—cord cutting—is projected to accelerate over the next five years. eMarketer estimates that by 2021, over 81 million U.S. consumers will have either cut their cords or never signed up for a cable package in the first place (up 64% from 2018). This cord-cutting trend will only impact the live-linear addressable portion of the overarching addressable umbrella (OTT obviously unaffected), but pay-TV providers are hoping that live-linear addressable, along with a host of other small incremental upgrades, may help curb this growing trend. Their theory: serve audiences more relevant messages and fewer annoying or irrelevant ads, and they are more likely to stay engaged with both the ad and the content said ad is running in. Time will tell if these small incremental changes encourage audiences to stay with pay TV. Our theory: good content and lower costs, no matter what other bells and whistles arrive, will always be the driving force in keeping and drawing in new audiences.

While traditional linear TV retains the highest reach, its viewership will continue to diminish, especially with younger demos, as cords are cut and viewership becomes more fragmented. As a result, more targeted and relevant ads will become that much more important both to advertisers looking to reach specific audiences via live-linear TV, and to cable or satellite providers looking to curb cord cutting and keep audiences engaged.

Three things we’ll be watching:

- Live-linear addressable is now available on a local level in all 210 DMAs, via Xandr. While scale is still an issue in markets outside the top 25, expect this scale to grow dramatically in the next 18 months (by December 2020), as Xandr expands their footprint and emerging competitors look to establish themselves.

- ATSC 3.0, the new broadcasting standard enabling interactive and addressable TV advertising on the big-four broadcast networks, is currently projected to be implemented in the top 40 U.S. TV markets by late 2020. As with many new technologies that require overhauls to hardware and adoption by consumers, it is unlikely we see ATSC 3.0 rolled out until 2021 or early 2022.

- The main purpose of both the forthcoming ATSC 3.0 and current addressable advertising is to serve more relevant ads to consumers. This is a win-win for both advertisers and consumers. As such, expect the conversation and innovation around addressable to grow, as well as increased adoption by advertisers as a complement to their video campaigns.